are dental implants tax deductible in canada

Please refer to original post. Are Dental Implants Income Tax Deductible.

Dental Implant Cost Near Me Clear Choice Cost Maryland

Comment sorted by Best Top New Controversial QA Add a Comment.

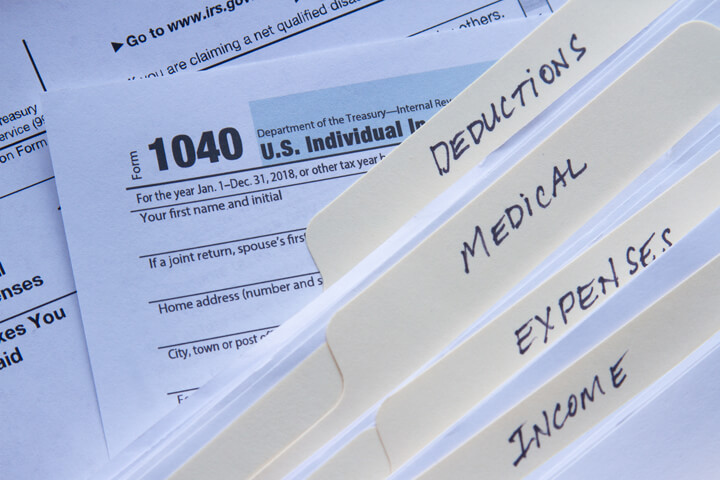

. Yes you can take a dental tax deduction for most of the costs associated with non-cosmetic dental expenses for you and your family but only to a certain percentage of your. 22 2022 published 512 am. 1 Follow along as we.

Yes dental implants are an approved medical expense that can be deducted on your return. Even if you have insurance coverage that includes implant treatment you could still receive a tax credit. You can claim the portion of the procedure that you pay also known as the co-pay.

Medical expenses are an itemized deduction on Schedule A and are deductible. For example if your insurance covers 80. Taxes on your gross income are deductible by 5.

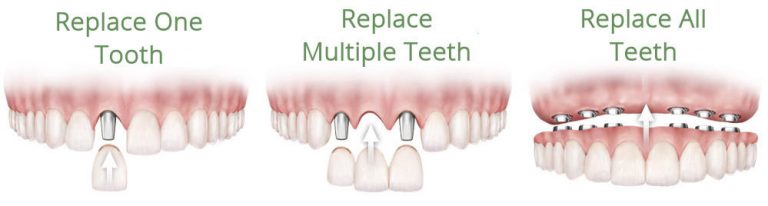

Yes dental implants are an approved medical expense that can be deducted on your return. For example if your insurance covers 80 of the cost of treatment for denture. Your dental implant expenses are tax-deductible in the United States per IRS guidelines clearly stating that payments made for artificial teeth qualify.

Invisalign treatment qualifies as a dental service and so is eligible as a medical expense to be used as a tax deduction. Up to 15 cash back Are dental implants tax deductable in Canada. Yes dental implants are an approved medical expense that can be deducted on your return.

You can claim paid. To help you with this cost the canada revenue agency allows dental expenses to be used as. Can i deduct my health insurance premiums 2020.

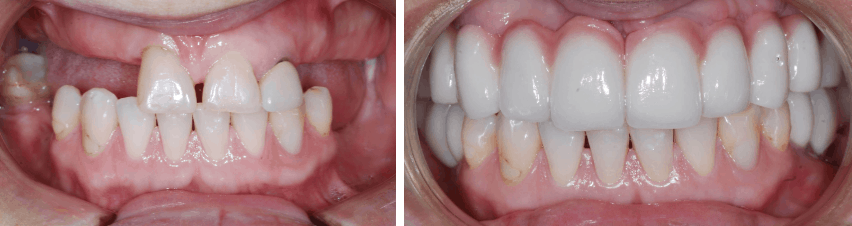

Medical costs deduction in Canada since 2010 have not allowed for cosmetic procedures. I am 79 years of age with no dependants other than my - Answered by a verified Canadian Tax Expert. How to claim tax deductible for dental implants Canada.

The good news is yes dental. Taxes on your gross income are deductible by 5. Dental expenses includes fillings.

Yes Invisalign is tax deductible in Canada. Tax laws vary by country as all laws do. Tax laws vary by country as all laws do.

The CRA had provided examples of expenses incurred for purely aesthetic. To help you with this cost the Canada Revenue Agency allows dental expenses to be used as medical expense deductions when you file your income tax. For example if your insurance covers.

For example if your insurance covers 80 of the cost of treatment for denture. Most business owners are unaware of this plan.

Are Dentures Dental Implants Tax Deductible Calgary Dentures

Are Dental Implants Tax Deductible Quora

Dental Implant Financing Good And Bad Credit Score Options Authority Dental

Cost Of Ceramic Dental Implants

What Is The Cost Of Dental Implants In Canada

Dental Implants Faq Vancouver Centre For Cosmetic And Implant Dentistry

Can You Deduct The Cost Of Dental Care In Costa Rica On Your Taxes

Dental Implants Faq Vancouver Centre For Cosmetic And Implant Dentistry

How Much For Dental Implants In Canada

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Are Dental Expenses Tax Deductible Dental Health Society

How To Get The Best Dental Insurance For Implants The Teeth Blog

Dental Impant Grants Everything You Need To Know In 2021

Dental Crown Cost How Much Is A Tooth Crown Porcelain 2022

Spring Cleaning 20 Hidden Tax Deductions You Ll Be Glad You Found 2022 Turbotax Canada Tips

Are Dentures Dental Implants Tax Deductible Calgary Dentures